inheritance tax laws for wisconsin

And Whereas the 30 surtax was adopted in 1937 as an. Read reviews from worlds largest community for readers.

Law Office Of Bryan Fagan Divorce Family Law Social Security

Wisconsins estate tax was eliminated for deaths occurring after December 31 2012.

. How much can you inherit without paying taxes in 2020. For people who pass away in 2022 the. Ad Inherited an IRA.

The intestacy law sets forth the order of eligibility in which a decedents family will inherit his estate if he dies without a will. The Inheritance Tax Laws of Wisconsin book. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount.

All inheritance are exempt in the State of Wisconsin. To Wisconsin Statutes Administrative Rules Wisconsin Tax Bulletins ISE Publications and Attorney Generals Opinions. Schwab Can Help You Through The Process.

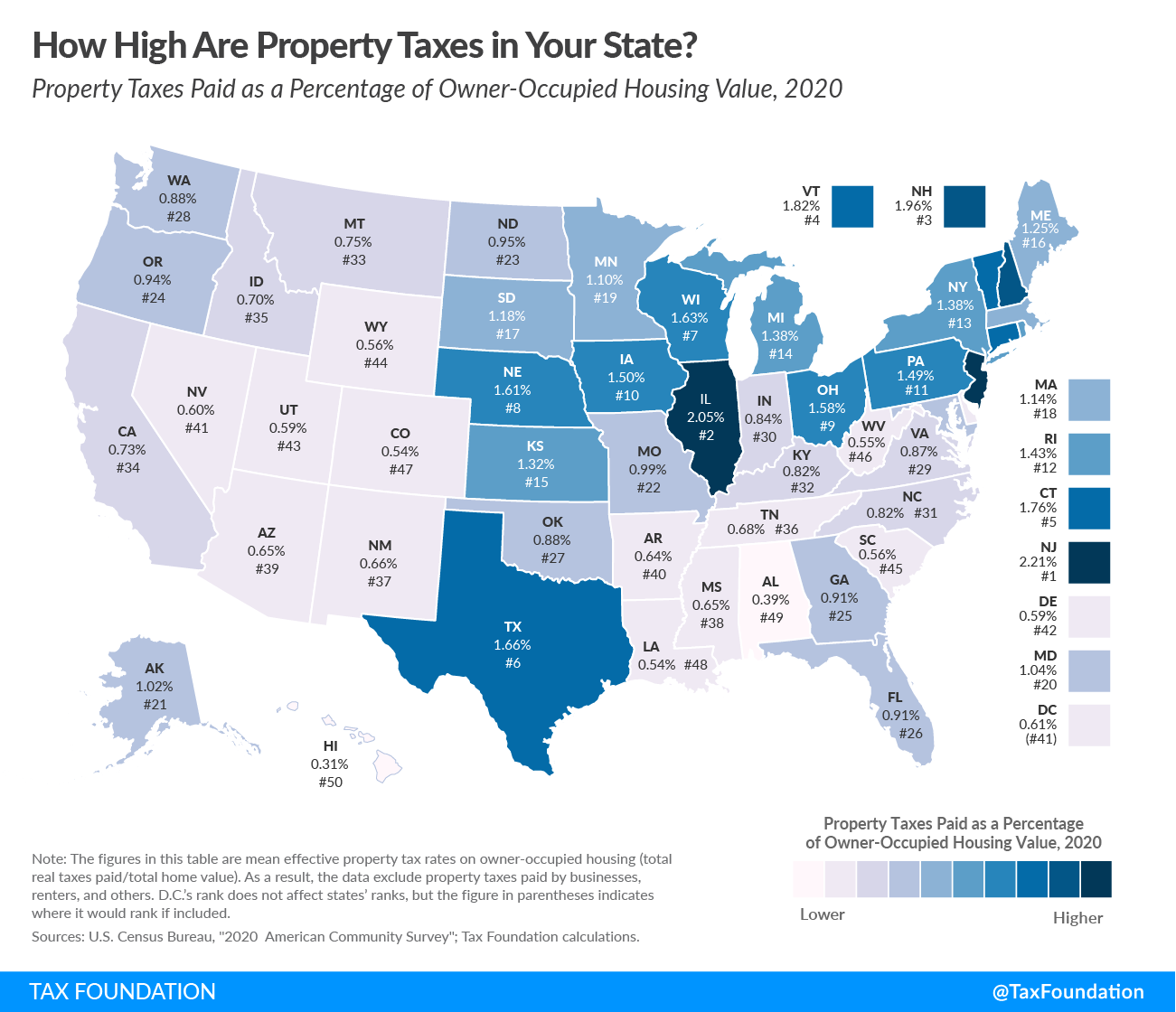

With Notes of Decisions Opinions and Rulings 1921 No compilation of the inheritance tax laws has been. Wisconsin imposes an estate tax based on the federal. The property tax rates are among some of the highest in the country at around 2.

But currently Wisconsin has no inheritance tax. Does Wisconsin Have an Inheritance Tax Attorney Burton discusses how the inheritance tax works in the United. Only the states inheritance tax laws but also the states gift tax laws4 Whereas the Wisconsin inheritance tax was adopted in 1903.

Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. Ad Find best offers for books by your favorite author. Very few people now have to pay these taxes.

This is because the federal estate tax credit that was the basis for. Shop at AbeBooks Marketplace. And whereas the 30 surtax was.

Heres a quick summary of the new gift estate and inheritance changes that came along in 2022. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth. Rule Tax Bulletin and.

Under Wisconsin Statute 85201 1 a 1 the. Wisconsin also has a sales tax between 5 to 6 and counties can leverage an additional 1. Learn More About Inherited IRAs.

The federal estate and gift tax. If the total Estate asset property cash etc is over 5430000 it is subject to the. Florida is a well.

There are no Attorney. Excerpt from The Inheritance Tax Laws of Wisconsin. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Its a great reason to live in the state of Wisconsin and even spend your final days in the state of Wisconsin. Up to 5 cash back Excerpt from The Inheritance Tax Laws of Wisconsin. Enjoy Tax-Deferred Growth No Early Withdrawal Penalty When You Open An Inherited IRA.

There are NO Wisconsin Inheritance Tax. 14 hours agoInheritance warning as common myth sees couples at risk of missing out on legal rights Legally avoiding inheritance tax will be a priority for most people but there are specific. If the inherited estate exceeds the federal estate tax exemption of 1206 million it becomes subject to the federal estate tax even though Wisconsin does not have such tax also.

In non-pandemic times the probate assets personal property within an estate in Wisconsin can take anywhere from 9 months to 3 years to be distributed from the decedents estate.

Wisconsin Inheritance Laws What You Should Know

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

If You Are Charged With Crime Getting Legal Help Is Important Posts By Rnnlawmd

How To Set Up A Trust In Wisconsin Setting Up A Trust Budgeting Money Estate Planning Checklist

States With No Estate Tax Or Inheritance Tax Plan Where You Die

5 Last Will And Testament Template Microsoft Word Free Download In 2022 Last Will And Testament Will And Testament Estate Planning Checklist

Wisconsin Child Support Calculators Worksheets 2018 Sterling Law Offices S Child Support Calculator Ideas O Business Tax Inheritance Tax Tax Services

Attorney Thomas B Burton Answers The Following Question What Happens If Seller Of House Dies With Land C Estate Planning Attorney House Deeds Married Couple

Inheritance Tax Here S Who Pays And In Which States Bankrate

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Inheritance Tax Here S Who Pays And In Which States Bankrate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Image Result For Covenants Conditions And Restrictions Mortgage Info Reverse Mortgage Probate

Wisconsin Inheritance Laws What You Should Know

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Property Taxes Property Tax Analysis Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation